PM announces Stage 3 Tax Cuts benefitting low and middle income earners

Simon Mumford

25 January 2024, 6:00 AM

Prime Minister Anthony Albanese announced his government's Stage 3 Tax Cuts today with July 1 the date that all taxpaying Australians will start receiving the tax benefits.

Depending on which side of the income scale you sit, will determine how happy you are about the tax cuts.

The Albanese Government says the new tax cuts are designed to provide bigger tax cuts for middle Australia to help with cost-of-living, while making our tax system fairer.

While high-income earners and the opposition are slamming the changes that were proposed by the former Morrison Government where people earning over $180,000 a year would get an extra $6,000 in their pockets while now they get $3,700.

A person earning $40,000 will now get an extra $654 in their pockets while under the previous plan, they would receive nothing.

In a statement today, the Albanese Government says it recognises the economic realities of 2024: Australians are under pressure right now and deserve a tax cut.

Labor’s tax cuts will make a real difference for 13.6 million Australians, ensuring that hard working Australians are keeping more of the wages they earn.

Building on the first budget surplus delivered in 15 years, Labor’s tax cuts deliver more relief to more people in a way that is fiscally responsible and doesn’t add to inflationary pressures.

Scott Morrison’s tax plan was designed five years ago, before the pandemic, before the global inflation spike, before interest rate rises and greater global uncertainty. It doesn’t do enough to help those who’ve been put under the most pressure by these changing circumstances.

We have found a more responsible way to ensure more people get a bigger tax cut to help ease the pressure they are under.

The Albanese Government’s tax cuts will deliver a bigger benefit for more Australians.

Our plan means every Australian taxpayer will receive a tax cut this year.

Our tax cuts are good for middle Australia, good for women, good for helping with cost-of-living pressures, good for labour supply and good for the economy.

From 1 July 2024, the Albanese Labor Government will:

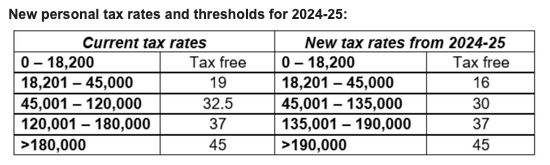

- Reduce the 19 per cent tax rate to 16 per cent (for incomes between $18,200 and $45,000).

- Reduce the 32.5 per cent tax rate to 30 per cent (for incomes between $45,000 and the new $135,000 threshold).

- Increase the threshold at which the 37 per cent tax rate applies from $120,000 to $135,000.

- Increase the threshold at which the 45 per cent tax rate applies from $180,000 to $190,000.

As a result of these changes, on July 1:

- All 13.6 million taxpayers will receive a tax cut – and 2.9 million more taxpayers will receive a tax cut compared to Morrison’s plan.

- 11.5 million taxpayers (84 per cent of taxpayers) will now receive a bigger tax cut compared to Morrison’s plan.

- 5.8 million women (90 per cent of women taxpayers) will now receive a bigger tax cut compared to Morrison’s plan.

- A person on an average income of around $73,000 will get a tax cut of $1,504 – that’s $804 more than they were going to receive under Morrison’s plan.

- A person earning $40,000 will get a tax cut of $654 – compared to nothing under Morrison’s plan.

- A person earning $100,000 will get a tax cut of $2,179 – $804 more than they would receive under Morrison’s plan.

- A person earning $200,000 will still get a tax cut, which will be $4,529.

In addition, the Government will increase the Medicare levy low-income thresholds for 2023-24.

This will benefit more than a million Australians, ensuring people on lower incomes continue to pay a reduced levy rate or are exempt from the Medicare levy.

Labor’s tax cuts will return bracket creep, increase the rewards for Australians who choose to work and earn more, boost labour supply and deliver a fairer share of tax relief to women.

Cutting taxes for middle Australia is a central part of our economic plan – along with getting wages moving again, bringing inflation under control and driving fairer prices for Australian consumers.

Our tax cuts come on top of the billions of dollars in targeted and responsible cost-of-living relief that’s being rolled out, including:

- Energy bill relief;

- Cheaper medicines;

- Cheaper child care;

- Strengthening Medicare;

- Higher income support payments; and

- The biggest boost to Rent Assistance in 30 years.

The Albanese Government is providing meaningful cost-of-living relief in a responsible way that doesn’t add to inflationary pressures, while laying the foundations for a stronger and more resilient economy.

The changes to the personal income tax system will have a net cost of $1.3 billion over the forward estimates. The total impact of these tax cuts is expected to be $107 billion over the forward estimates.

The increase to the Medicare levy low-income thresholds is expected to cost $640 million over four years from 2023-24. This was accounted for in the 2023-24 Mid-Year Economic and Fiscal Outlook.

On the other side of the ledger, Nationals leader David Littleproud said:

“Prime Minister Anthony Albanese and Labor have not only lied to Australians about reducing their power bills by $275 but also on more than 100 occasions about tax relief promised to Australian workers,” Mr Littleproud said.

“The Prime Minister has chosen the Labor Party’s selfish short-term political interests over the last phase of sensible tax reform that would correct tax bracket creep for families now and into the future.

“No one can trust the Prime Minister when he has broken another central election promise to all Australian families.

“Real leadership wouldn’t destroy needed tax reform for short-term political gain.

“The fact the government only sought advice from Treasury on the cost-of-living crisis in December begs the question, where have they been?

“Did they only just realise there was a problem?

“The Prime Minister was distracted for a year on the failed Referendum that divided Australia, while inflation and cost-of-living raced out of control.

“Labor’s changes do nothing to deal with the real cost-of-living pressures impacting families such as skyrocketing electricity bills, supermarket food prices and home mortgage increases.”

To find out how much the Government’s tax cuts will benefit you, use the calculator on the Treasury website: https://treasury.gov.au/tax-cuts/calculator